|

Chartiable Gift Appraisal

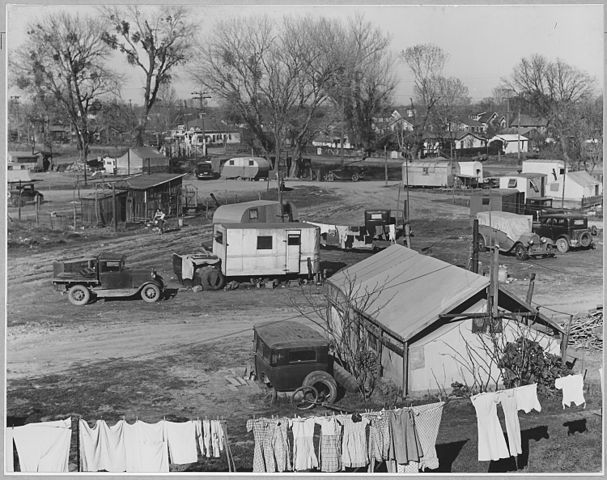

Depression Era Sacramento 1940 Thank you for your contribution. We are sure your sharing will go to a worthy cause. Appraisals are needed for Charitable Gifts or Donations to satisy IRS requirements. We can help with the appraisal requirement. per IRS Publication 561 "To figure how much you may deduct for property that you contribute, you must first determine its fair market value on the date of the contribution" You will need a "Qualified Appraisal" from a "Qualified Appraiser" as defined: "Has earned an appraisal designation from a recognized professional appraiser organization for demonstrated competency in valuing the type of property being appraised..." We are California State Licensed and meet the definition for "Qualified Appraiser" A Qualified Appraisal means one that adheres to "generally accepted appraisal standards" per IRS. The most generally accepted appraisal standard in the United States is USPAP. Our appraisals meet USPAP guidelines. We can provide a Qualified Appraisal for these property types: Single Family Residence 2-4 Unit Property Condominium Vacant Land (subdivision lot only). To order an appraisal, simply click here or email for a quick quote.

|